Answer:

1. decrease, $ 3 million, decrease, $ 15 million

2. TRUE

3. TRUE

Step-by-step explanation:

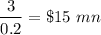

1. The reverse requirement is given as r = 0.2

The money multiplier is

Now when the monetary base is changed by $3 million, then the total money supply will change by

.

.

Of the $ 15 mn, the reverse will change by $ 15 mn x 0.2 = $ 3 mn.

If Fed sells the government bond of $ 3 million, then the money supply will reduce and the economy's reverses will decrease by $ 3 million and the money supply will decrease by $ 15 million.

2. TRUE

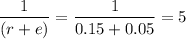

Now if the bank reduces the reserve ratio but he bank maintains excess reserves, then the money multiplier =

Therefore, the money multiplier will remain same, it will remain unchanged.

3. TRUE.

Since the money multiplier remains constant, the overall change in money supply will not increase. It remains the same.