Answer:

The responses to the given choices can be defined as follows:

Step-by-step explanation:

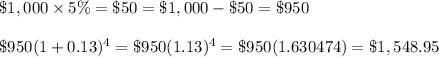

Assume is the investment. Each original Class A investment is of the net-front unburden. The portfolio will be worth four years from now:

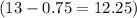

You will place the total of

on class B shares, but only

on class B shares, but only

will be paid

will be paid

at a rate of

at a rate of

and you'll pay a

and you'll pay a

back-end load charge if you sell for a four-year period.

back-end load charge if you sell for a four-year period.

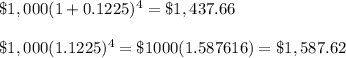

After 4 years, your portfolio worth would be:

Their portfolio worth would be: after charging the backend load fee:

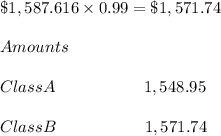

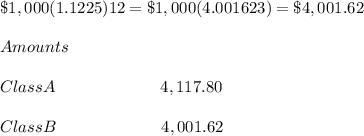

When the horizon is four years, class B shares are also the best option.

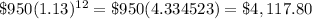

Class A shares would value from a 12-year time frame:

In this case, no back-end load is required for Class B securities as the horizon is larger than 5 years.

Its value of the class B shares, therefore, is as follows:

Class B shares aren't any longer a valid option in this, prolonged duration. Its impact on class B fees of

cumulates over a period and eventually outweighs the

cumulates over a period and eventually outweighs the

the burden of class A shareholders.

the burden of class A shareholders.