Answer:

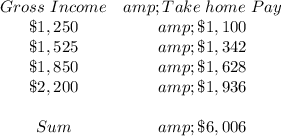

Michael's take home pay from each job are;

Explanation:

The given parameters are;

The percentage of Michael's income that he estimates will go to his taxes = 12%

The number of jobs Michael has = Four jobs

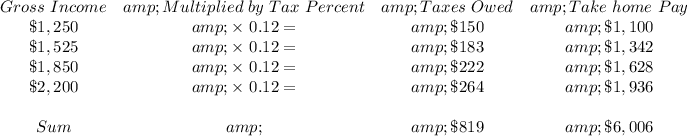

The table Michael created can be presented and the estimated taxes and the take home pay entered as follows;

Tax owed = Gross income × Tax percent

Take home pay = Gross income - Tax owed