Answer:

The right solution is "$178.86".

Step-by-step explanation:

The given values are:

Interest rate,

= 10%

New nominal interest rate,

= 8%

Years,

= 24

As per the question,

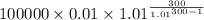

On the original loan, the annul installments will be:

=

=

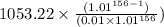

($)

($)

As we know,

The remaining 156 instalments are charged throughout the PV after the 144th deposit,

=

=

($)

($)

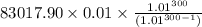

On the refinanced loan, the annul installments will be:

=

=

($)

($)

hence,

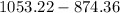

After refinancing, the difference in mortgage will be:

=

=

=

($)

($)