Answer:

Explanation:

Given

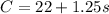

Speaker set to cost $22

Each song costs $1.25

Sales tax is 7.5%

Suppose, one purchase s no of songs

The cost of s songs is $1.25s

The combined cost of speakers and song is

At this cost, a 7.5% sales tax is applied to the given cost

![\Rightarrow [22+1.25s]* 0.075](https://img.qammunity.org/2022/formulas/mathematics/high-school/pdk4zpqqfkx1lrfkej91elxebqzju1k2br.png)

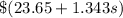

Total cost after sales tax is

![\Rightarrow C_t=22+1.25s+[22+1.25s]0.075\\\\\Rightarrow C_t=[22+1.25s](1+0.075)=[22+1.25s]* 1.075\\\\\Rightarrow C_t=\$(23.65+1.343s)](https://img.qammunity.org/2022/formulas/mathematics/high-school/2dk22555qweg744zed9mxxqkmy4m01pm3f.png)