Answer:

Step-by-step explanation:

1)

To determine the net settlement;

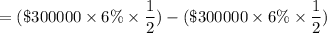

For June 30th:

The net cash receipt = receiving floating interest - pay fixed interest

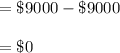

For December 31st:

Net cash receipt =

2)

Journal Entries for the period of January 1 to December 31, 2021

Date General Journal Debit ($) Credit($)

Jan 1 Cash Account/current (A/C) 300000

Note Payable Account/current 300000

To record the debt

June 30 Interest expense A/C

9000

9000

To cash A/C 9000

June 30 other huge income (A/C)

(3100 - 0) 3100

Interest rate swap 3100

To record the change in

derivative fair value

At June 30, 2021;

Since the cash settlement is

focused on beginning-of-year

rates (when both fixed and floating

rates were 6%), there is no cash

exchanged for interest rate swap

settlement. It does recognize a fall in the

the fair value of the interest rate trade in the

following half-year because of lower

interest rates. Other comprehensive huge

income is calculated to reflect the decline

in fair value.

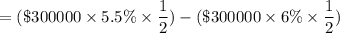

Dec 31 Interest expense A/C

8250

8250

To cash A/C 8250

To record interest

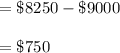

Dec 31 Interest expense A/C

750

750

To cash A/C 750

To record net cash settlement

Dec 31 Interest rate swap A/C 7100

other huge income 7100

To record change in derivative

of the fair value

$3100(June 30) + $4000(Dec 30)

(Fair value swap)