Answer:

Var = 6.31

Explanation:

The Value at Risk (VAR)

By using normal distribution

Mean

= 10

= 10

Variance = 49

Standard deviation

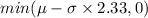

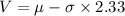

This implies that:

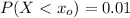

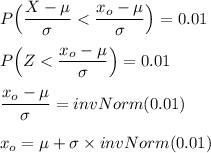

Using the z-table;

Hence, there exist 1% chance that X < -6.31 or the loss from investment is > 6.31

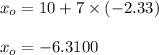

From the calculated value above;

; Since the result is negative, then it shows that the greater the value(i.e the positive or less negative it is ) the lower is the value of VAR. Thus, the least value of VAR is accepted by the largest value of

; Since the result is negative, then it shows that the greater the value(i.e the positive or less negative it is ) the lower is the value of VAR. Thus, the least value of VAR is accepted by the largest value of