Answer:

Option d (110,670) is the right option.

Step-by-step explanation:

The given values are:

Selling price,

= $102 per unit

Fixed manufacturing overhead,

= $51,100

Fixed selling and administrative expense,

= $3,100

Now,

Sales will be:

=

=

($)

($)

Variable expenses:

Direct material will be:

=

=

($)

($)

Direct labor will be:

=

=

($)

($)

So,

Variable manufacturing overhead will be:

=

=

($)

($)

Its selling as well as administrative will be:

=

=

Hence,

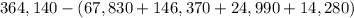

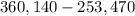

The contribute margin will be:

=

=

=

($)

($)