Answer:

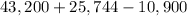

The correct answer is "58,044".

Step-by-step explanation:

The given values are:

Service cost,

= $43,200

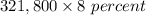

Accumulated postretirement benefit obligation,

= 321,800

Actual and expected return,

= 10,900

Discount rate,

= 8%

The interest cost will be:

=

=

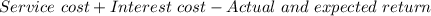

The Postretirement benefit expense will be:

=

=

=