Answer:

takes on the shape of an inverted U so related diversification has the best performance.

Step-by-step explanation:

A portfolio variance is used to determine the overall risk or dispersion of returns of a portfolio and it is the square of the standard deviation associated with the particular portfolio.

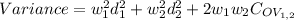

The portfolio variance is given by the equation;

Where;

= the weight of the nth security.

= the weight of the nth security.

= the variance of the nth security.

= the variance of the nth security.

= the covariance of the two security.

= the covariance of the two security.

The relationship between the type of diversification and overall firm performance takes on the shape of an inverted U, so related diversification has the best performance.