Answers:

Question 1: The equations share the same slope, but different y-intercepts.

Question 2: Option B (y = 2x + 1)

Explanations:

For Question 1:

Both equations are written in slope intercept form.

The equations we have are:

Both equations share the same slope of 2. However, they have different y-intercepts.

y = 2x can be written as y = 2x + 0.

Usually if you only have the slope in your equation then the y-intercept is the origin, or (0, 0).

The second equation's y-intercept is -7. It takes 'b's place.

For Question 2:

We are given a graph and we need to find a equation.

According to the graph, the line passes at (0, 1). 1 is the y - intercept.

Since y = 2x + 1 is the only option with 1 as the y - intercept, it should be the correct answer.

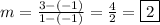

I'll do the slope as well to verify our answer.

I will use the points (-1, -1) and (1, 3).

The correct answer should be

.

.

Hope this helps you.