Answer:

Step-by-step explanation:

A.)

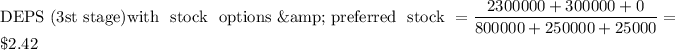

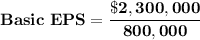

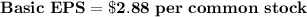

The Basic EPS can be determined by using the formula:

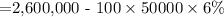

∴

B.)

The calculations for the numerator and denominator effect are:

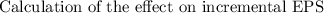

Convertible on preferred stock

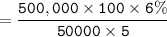

Convertible Bond

= 2.80

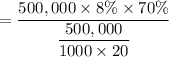

Stock options

= 0

Determination of the numerator & denominator effect for each convertible securities shown above are:

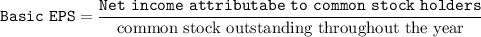

Numerator (N) Denominator (D) Dilution index = N/D

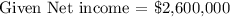

Net income $2,600,000

Less: Preferred $300000

Dividend

Common stock A

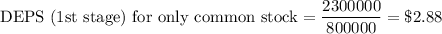

Net income $2,300,000 800,000 2.875

Add: Stock

Options (B) 0 25000

Total (C) = (A + B) $2300000 825000 2.788

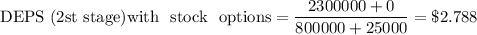

Add: Convertible

Bonds (D) 428000 10000

Total (E) = (C+D) $2328000 835000 2.787

Add: Convertible

Preferred Stock (F) $300000 250000

Total (E) + (F) $2628000 1085000 2.422

C.)

Particulars Dilutive Index Rank (most dilutive is 1.)

Stock Option 2.788 1

Convertible Bonds 2.787 3

Preferred Stock 2.422 2

D.)

From above, the convertibles are diluted EPS (DEPS)

÷

÷