Solution :

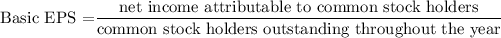

A). Calculating the basic EPS

Given :

Net income = $ 2,600,000

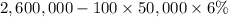

So, the net income available for the common stock holders = net income given less dividend to preferred stock holders =

= $ 2,300,000

The common stock outstanding throughout the year = 800,000

Therefore,

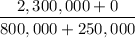

Basic EPS =

= $ 2.88 per common stock

B). The convertible preferred stock =

= 1.20

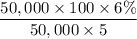

Convertible bond =

= 2.80

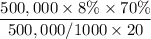

Stock options =

![$(0)/([100,000-(100,000 * 60/80)])$](https://img.qammunity.org/2022/formulas/business/college/dgtxyfyts2rpuqx192e46fh8d02c8av7eb.png)

= 0

Now, calculating the numerator and the denominator effect for each of the above convertible securities are :

Numerator Denominator Dilution index

Net Income 2,600,000

Less:Preferred dividend 3,00,000

Net income for common 2,300,000 800,000 2.875

stock (A)

Add: Stock options(B) 0 24,000

Total(C)=A+B 2,300,000 825,000 2.788

Add:Convertible bonds(D) 28,000 10,000

Total (E)= C+D 2,328,000 835,000 2.787

Add: convertible preferred 300,000 250,000

stock (F)

Total (E+F) 2,628,000 1,085,000 2.422

C). Particulars Dilutive index Rank

Stock option 2.788 1

Convertible Bonds 2.787 3

Preferred Stock 2.422 2

D). On the basis of above ranks, the convertible bonds are anti diluter. So the same cannot be included to find out the EPS.

Diluted EPS =

/

/

So, diluted EPS (stage 1) only common stock =

= $ 2.88

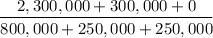

Diluted EPS (stage 2) with stock options =

= $ 2.788

The final stage diluted EPS with the stock options and the preferred stock =

= $ 2.42