Answer:

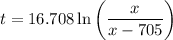

(a) $897.72: 26 yr

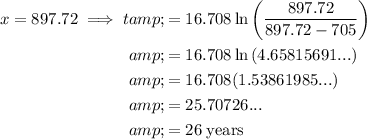

$1526.49: 10 yr

(b) See below.

(c) x = 705

more, $705, longer it will take

Explanation:

Given equation:

where:

- t = term of the mortgage (in years)

- x = monthly payment plan (in dollars)

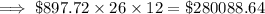

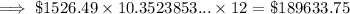

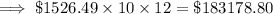

Part (a)

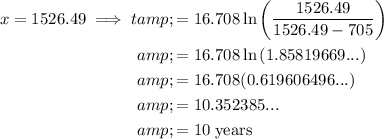

Part (b)

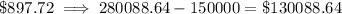

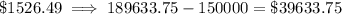

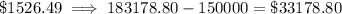

To approximate the total amounts paid (in dollars) over the term of the mortgage, multiply the monthly payment by the term.

Please note I have provided two calculations per monthly payment:

(1) by using the exact term, and (2) using the rounded term from part (a).

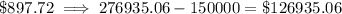

To calculate the amount of interest costs (in dollars) in each case, subtract $150,000 from the total amounts paid:

Part (c)

The natural logarithm of a negative number cannot be taken.

Therefore, x > 705.

So the vertical asymptote for the model is:

The monthly payment must be more than $705, and the closer to this value the payment is, the longer it will take to pay off the mortgage.