Answer:

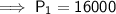

$16,000

Explanation:

Simple Interest Formula

I = Prt

where:

- I = Interest accrued

- P = Principal amount

- r = Interest rate (in decimal form)

- t = Time (in years)

Let investment 1 be the bond that pays 5.75% simple interest.

Let investment 2 be the bond that pays 7.25% simple interest.

Given:

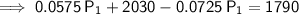

- P₁ + P₂ = $28,000

- r₁ = 5.75% = 0.0575

- r₂ = 7.25% = 0.0725

- t = 1 year

Create two equations for the interest from both investments.

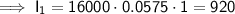

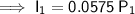

Interest from Investment 1

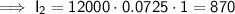

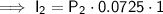

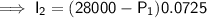

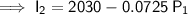

Interest from Investment 2

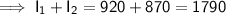

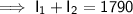

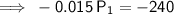

Given that the sum of the interest from both investments is $1,790:

Therefore, $16,000 should be invested in the 5.75% bond.

Check: