Answer:

$154.07

Explanation:

First find the Future Account Value (target amount) you need at the beginning of your retirement in order to earn $50,000 of interest each year whilst leaving the principal untouched.

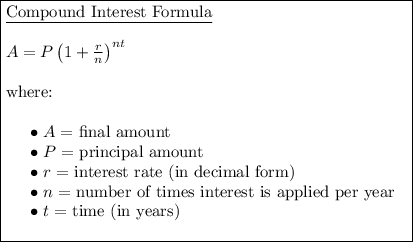

Given:

- A = P + $50,000

- P = P

- r = 11% = 0.11

- n = 12 (monthly)

- t = 1 year

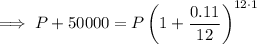

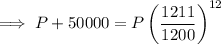

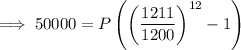

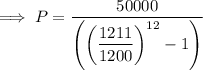

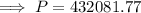

Substitute the values in the compound interest formula to find the Future Account Value:

Therefore, the Future Account Value needed at the beginning of your retirement is $432,081.77 to allow you to earn $50,000 per year from interest alone.

![\boxed{\begin{minipage}{8.5 cm}\underline{Savings Plan Formula}\\\\$ FV=PMT\left[(\left(1+(r)/(n)\right)^(nt)-1)/((r)/(n)) \right]$\\\\where:\\\\ \phantom{ww}$\bullet$ $FV =$ future value\\ \phantom{ww}$\bullet$ $PMT =$ periodic payment \\ \phantom{ww}$\bullet$ $r =$ APR (in decimal form) \\ \phantom{ww}$\bullet$ $t =$ years \\ \phantom{ww}$\bullet$ $n =$ number of payments per year \\ \end{minipage}}](https://img.qammunity.org/2023/formulas/mathematics/high-school/ej4lm2ehgy9te1ey5fc4a7u0g2e6144nr8.png)

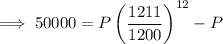

Given:

- FV = $432,081.77

- r = 11% = 0.11

- t = 30 years

- n = 12 (monthly)

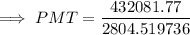

Substitute the values into the Savings Plan formula and solve for PMT to find the monthly payments:

![\implies 432081.77=PMT\left[(\left(1+(0.11)/(12)\right)^(12 \cdot 30)-1)/((0.11)/(12)) \right]](https://img.qammunity.org/2023/formulas/mathematics/high-school/snxet75f06jsue8ywtcrt9u46zh846xj1k.png)

![\implies 432081.77=PMT\left[(\left((1211)/(1200)\right)^(360)-1)/((11)/(1200)) \right]](https://img.qammunity.org/2023/formulas/mathematics/high-school/orlo8c75y1vbcsb2ri3om2b3wk1rcnr8ny.png)

![\implies 432081.77=PMT\left[2804.519736 \right]](https://img.qammunity.org/2023/formulas/mathematics/high-school/c2kt9xr8t9nhzkx3ix50b8qd76c5as02qh.png)

Therefore, you should deposit $154.07 at the end of each month to be able to withdraw $50,000 per year from interest alone at the end of each year after you retire in 30 years.