Answer:

The values in the second column represent dollar figures.

There's no need to type in the dollar symbol into the boxes since each dollar sign is taken care of by your teacher.

I would avoid typing commas into the boxes since it might cause the computer to mark the answer wrong.

==================================================

Work Shown:

- P = 2100 dollar deposit

- r = 0.085 = annual interest rate in decimal form

- t = 9 years

These values will be used in every section, including the final section at the bottom. For the first five sections, the only input that changes is the value of n.

--------------------

n = 1 = annual or 1 time a year compounding

A = P*(1+r/n)^(n*t)

A = 2100*(1+0.085/1)^(1*9)

A = 2100*(1.085)^9

A = 2100*2.08385570683634

A = 4376.09698435631

A = 4376.10

Therefore, if the money is compounded 1 time per year (aka annually), then you'll have $4,376.10 in the account after the 9 year period. The interest rate must stay at 8.5%; also you cannot deposit nor withdraw money from this account.

We'll repeat these similar steps for the other sections, with the exception of the last section that uses a different formula.

Your steps or work shown to your teacher doesn't need to be as verbose as I have written above. You can have this shortened version like this perhaps:

A = P*(1+r/n)^(n*t)

A = 2100*(1+0.085/1)^(1*9)

A = 4376.09698435631

A = 4376.10

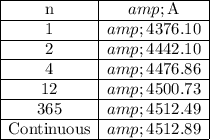

I'm choosing to be a bit "wordy" in terms of steps to show how the order of operations PEMDAS is playing out. Use of a spreadsheet is recommended to quickly compute these values, as well as organize the items in a handy table (as shown above).

--------------------

n = 2 = semiannual compounding, aka every 6 months

A = P*(1+r/n)^(n*t)

A = 2100*(1+0.085/2)^(2*9)

A = 2100*(1+0.0425)^(18)

A = 2100*(1.0425)^18

A = 2100*2.11528624641441

A = 4442.10111747027

A = 4442.10

--------------------

n = 4 = quarterly compounding

A = P*(1+r/n)^(n*t)

A = 2100*(1+0.085/4)^(4*9)

A = 2100*(1+0.02125)^(36)

A = 2100*(1.02125)^(36)

A = 2100*2.13183949332905

A = 4476.86293599101

A = 4476.86

--------------------

n = 12 = monthly compounding

A = P*(1+r/n)^(n*t)

A = 2100*(1+0.085/12)^(12*9)

A = 2100*(1+0.0070833333)^(108)

A = 2100*(1.0070833333)^(108)

A = 2100*2.14320709156311

A = 4500.73489228253

A = 4500.73

---------------------

n = 365 = daily compounding, ignoring leap years

A = P*(1+r/n)^(n*t)

A = 2100*(1+0.085/365)^(365*9)

A = 2100*(1+0.000232876712328767)^(3285)

A = 2100*(1.00023287671233)^(3285)

A = 2100*2.14880299048115

A = 4512.48628001041

A = 4512.49

---------------------

The continuous case:

As n gets larger, it appears that the value of A is approaching around $4512.49 or so. Perhaps the amount may be slightly larger.

To account for n going to infinity, we use the continuously compounded interest formula

A = P*e^(r*t)

to plug in

The 'e' refers to the special constant e = 2.718...

Let your calculator handle this value. There should be a button with the single letter "e" on it.

So,

A = P*e^(r*t)

A = 2100*e^(0.085*9)

A = 4512.88818677718

A = 4512.89

Each result is shown in the table at the top of the solution.

Don't forget to round to the nearest hundredth.