Answer: Option B

Compounded quarterly; annual interest rate is 7.875%

========================================================

Step-by-step explanation:

Let's say we are depositing P = 100 dollars, and we leave it in the account for a timespan of t = 1 year.

This will apply for options A through E.

-------------------

If we go with option A, then we would have n = 1 and r = 0.08

Use the compound interest formula to get the following:

A = P*(1+r/n)^(n*t)

A = 100*(1+0.08/1)^(1*1)

A = 108

We'll have $108 dollars in the account at the end of 1 year if we go with option A. The amount of interest only is A-P = 108-100 = 8 dollars.

-------------------

For option B, we have: n = 4 and r = 0.07875

A = P*(1+r/n)^(n*t)

A = 100*(1+0.07875/4)^(4*1)

A = 108.110625948487

A = 108.11

So far option B is slightly better since you've earned an extra $0.11, aka 11 cents.

-------------------

For option C, we have: n = 4 and r = 0.07875

A = P*(1+r/n)^(n*t)

A = 100*(1+0.0775/12)^(12*1)

A = 108.031299777277

A = 108.03

This amount is less compared to the $108.11 with option B. Therefore, option B is still the best so far.

-------------------

For option D, we have: n = 52 and r = 0.07625

A = P*(1+r/n)^(n*t)

A = 100*(1+0.07625/52)^(52*1)

A = 107.917207523206

A = 107.92

This is worse compared to option C.

Option B is still the best so far.

-------------------

For option E, we have: n = 365 and r = 0.075

A = P*(1+r/n)^(n*t)

A = 100*(1+0.075/365)^(365*1)

A = 107.787584644

A = 107.79

---------------------

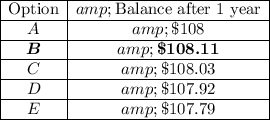

Here's a table comparing the balance after 1 year for options A through E. Those balances all have a starting point of $100 as the deposit.

Option B is the best choice earning the most ($108.11) if you deposit $100.

There's nothing special about the $100, so feel free to change it to something else to try other starting deposits. You'll find that option B will still provide the highest return.