In this case, we can apply the formula for the future value of an investment, which is:

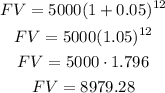

Where FV is the future value, PV is the principal value = $5,000, I is the interest rate in decimal form I=5%/100%=0.05 and n is the number of compounding periods, n=12.

By replacing these values in the formula we obtain:

So, after 12 years there will be $8979.28 in the savings account.