Part 1

Simple interest

we know that

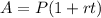

The simple interest formula is equal to

where

A is the Final Investment Value

P is the Principal amount of money to be invested

r is the rate of interest

t is Number of Time Periods

in this problem we have

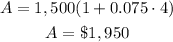

P=$1,500

r=7.5%=0.075

t=4 years

substitute in the formula

Part 2

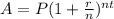

The compound interest formula is equal to

where

A is the Final Investment Value

P is the Principal amount of money to be invested

r is the rate of interest in decimal

t is Number of Time Periods

n is the number of times interest is compounded per year

in this problem we have

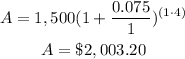

P=$1,500

r=7.5%=0.075

t=4 years

n=1

substitute

therefore

A better investment is a compound interest

Find out the difference

2,003.20-1,950=$53,20

so

Is earned $53,20 more