Step-by-step explanation:

Let x be the amount the woman invests in the 15% bond. Then the amount she invested in her CD is given by:

Now, the interest she receives from the 15% bond is given by:

while the interest she receives from the 7% CD is given by:

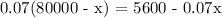

Now, given that her total annual interest is $6,000, then

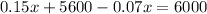

this is equivalent to:

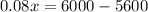

solving for x, we obtain the amount the woman invests in the 15% bond:

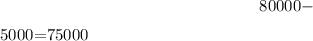

Therefore, the amount of dollars she will be able to invest in her CD is

Thus, we can conclude that the correct answer is:

Answer:

The amount the woman invests in the 15% bond:

$5000

Amount of dollars she will be able to invest in her CD:

$75000