We can described the position, in function of time, for the adults and the kids, taking into account where they start and how fast they move.

For the kids, the start at position x=18. They hobbled at a rate of 2 yards per second.

Then, if t is the time in seconds, they change their position 2t for time t.

We then can write the position of the kids in function of time as:

For the adults, they start at the initial position (x=0) but hobbled ar 3 yards per second, so their position is:

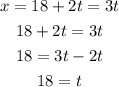

Then, we can write the system of equations as:

We can solve it by replacing x from the first equation in the second one:

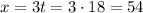

Then, the value for x is:

Then, we can conclude that:

It took 18 seconds for the adults to go 54 yards and catch up to the kids.