Given:

There are given that the Martina planning to fly 1000km north.

Step-by-step explanation:

According to the question:

(a):

Let v represent the velocity:

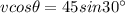

So,

Then,

Put 500 for the value of v into the above formula:

So,

![\begin{gathered} vcos\theta=45s\imaginaryI n30^{\operatorname{\circ}} \\ 500cos\theta=45*(1)/(2) \\ cos\theta=(45)/(1000) \\ \theta=cos^(-1)(45)/(1000) \\ \theta=87.42 \end{gathered}]()

Final answer:

Hence, the direction of the pilot head is northeast because the degree of rotation is 87.42 degrees.