$67247.39

Step-by-step explanation

Step 1

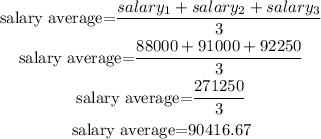

find the average of the 3 highest years salaries

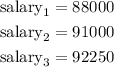

Let

hence

Step 2

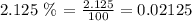

find the 2.125 % of salary average

so, to find the 2.125 % of any number, multiply the number by 0.02125

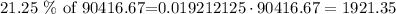

Hence

Step 3

find the pension

pension that is calculated by multiplying the number of years worked times 2.125% of the average of the 3 highest year's salaries.

Let

years John worked=35

replace

I hope this helps you