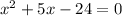

The parabola equation given is,

I will be resolving the answers using graph.

The graph of the function will be shown below

From the graph above, the roots or the zeros of the parabola are the points where the curve touches the x-axis.

Hence, the roots/zeros of the parabola is

Also, the y-intercept of the parabola is the point where the curve touches the y-axis.

Therefore, the y-intercept is

Hence, there are two roots which are -8 and