Fedor's annual income last year was $85,300

Here, we want to use the list of relationships between total tax and annual income to determine the annual income last year

What we will do here is to look at the value of the income tax

Afterwards, we can check the range in which it falls

From the different ranges given, we can see that the value $14,761.50 falls on the fourth range

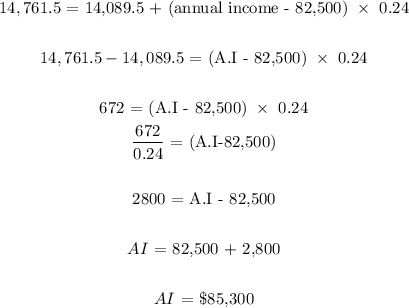

The relationship is given by;

We simply equate this to the value of the income tax given

That would be;