Given:

Annual Salary = $13,500

Let's calculate his yearly taxes below.

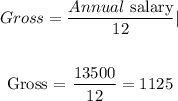

• 1. Gross monthly income.

To find the gross monthly income, apply the formula below:

The gross monthly income is $1,125

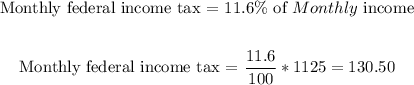

• 2. Monthly Federal Income Tax (11.6%):

To find the monthly Federal income tax which is 11.6% of monthly income, we have:

The monthly Federal income tax is $130.50

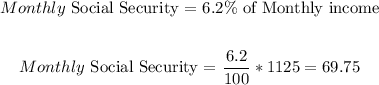

• 3. Monthly Social Security (FICA (6.2%)):

The Monthly Social Security is $69.75

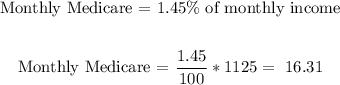

• 4. ,Monthly Medicare (1.45%)

The Monthly Medicare is $16.31

• 5. Monthly State Tax (4%):

The Monthlys State Tax is $45

• 6. ,Monthly Local Tax (0.1%):

The Monthly Local Tax is $1.125

• 7. Total Monthly deductions:

To find the Total Monthly Deductions, sum up all the monthly taxes.

We have:

Total Monthly deductions = $130.50 + $69.75 + $16.31 + $45 + $1.125 = $262.685

Therefore, the total monthly deductions is = $262.685

8. Net Monthly Income:

To find the Net Monthly Income, subtract the Total Monthly Deductions from the Gross Monthly income.

We have:

Net Monthly Income = Gross Monthly Income - Total Monthly Deductions

= $1125 - $262.685 = $862.315

Therefore, the Net Monthly Income is $862.315

ANSWER:

Gross Monthly Income = $1,125

Monthly Federal Income Tax(11.6%) = $130.50

Monthly Social Security (FICA (6.2%) = $69.75

Monthly Medicare (1.45%) = $16.31

Monthly State Tax (4%) = $45

Monthly local Tax (0.1%) = $1.125

Total Monthly Deductions = $262.685

Net Monthly Income = $862.315