SOLUTION

Venn diagrams are visual representations of mathematical sets or collections of objects that are studied using a branch of logic called set theory. Set theory is one of the foundational systems for mathematics, and it helped to develop our modern understanding of infinity and real numbers.

Venn diagrams are usually represented using circles which show a set of items.

Consider a set of 15 students who offer Chemistry in a class and another set of 20 students who offer Physics in the same class, we can represent this by the Venn diagram below as

So circle C represents all the students that offer Chemistry and circle P represents all the students that offer Physics. The rectangular box shows all the students in that class that offer both physics and chemistry. The U sign is a sign for Universal set. It tells us all the students present in the class. So, 15 + 20 = 35

Assume we are told that out of 35 students in total, 15 offer Chemistry, 15 offer Physics and 5 offer none of Physics or Chemistry, then this would be represented as

You can see that the 5 is not part of the circles C for chemistry or P for physics. So it is written outside. And the Universal set, that is the total students remains 15 + 15 + 5 = 35.

Now, Lets solve an example question.

Example: In a class of 35 students, who offer chemistry, or physics or both, or neither of them, 15 offer Chemistry, 20 offer Physics and 5 offer neither chemistry nor physics. Find:

the number of students that offer both chemistry and physics

SOLUTION

Let's represent this using a Venn Diagram

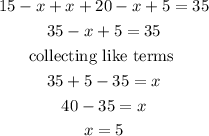

From the diagram above, the number of students that offer both chemistry and physics is represented by the center labelled as x. It is known as the intersection between both. Now to find the number that offer both chemistry and physics, we sum everything in the rectangle to equal 35, which is the universal set. This becomes

So the number of students that offer both subjects is 5