(a)

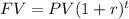

The formula for future value of an amount of money is given by >>>

Where

FV is the future value

PV is the present value

r is the rate of interest per period, in decimal

t is the time period

Given,

PV = 8806.54

Rate of interest is 6% annual, so semi annual compounding means that r = 6%/2 = 3% = 0.03

In 7 years, there are 7 x 2 = 14 compoundings, since semi annual compounding. We use t = 14

Plugging all the information, we get:

The future value at semi-annual compounding is $13,320.68

The interest earned is about $13,320.68 - $8806.54 = $4514.14

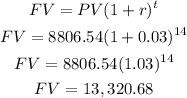

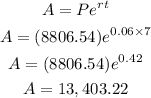

(b)

When we are continuously compounding, we use a slightly different formula. That is

Where

A is the future value

P is the initial amount

r is the rate of interest

t is the time period

We know,

P = 8806.54

r = 6% = 0.06

t = 7

So, plugging in gives us,

The future value at continuous compounding is $13,403.22

The interest earned is about $13,403.22 - $8806.54 = $4596.68