Given:

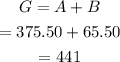

The regular pay amount is, A = $375.50.

The overtime pay amount is, B = $65.50.

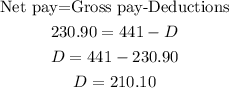

The net pay for the week is, P = $230.90.

The objective is to find the deduction amount for the week.

The gross pay for a week with can be calculated as,

Now, the deduction can be calculated as,

Thus, the deduction amount is $210.10.

Hence, option (b) is the correct answer.