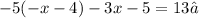

Given the following equation:

You can solve for the variable "x" by following the steps shown below:

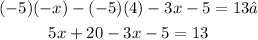

Step 1. Apply the Distributive property by multiplying eact term inside the parentheses by -5:

Step 2. Add the like terms on the left side of the equation:

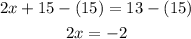

Step 3. Apply the Substraction property of equality by subtracting 15 from both sides of the equation:

Step 4. Finally, apply the Division property of equality by dividing both sides of the equation by 2:

The answer is:

Did you understand?