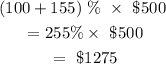

Original cost of antique clock = $500

Mark up = 155%

New cost of the antique clock after mark up is:

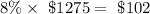

Emma paid an additional 8% in sales tax. The new cost price as at the time Emma bought the antique clock is $1275. Hence, the sales tax on the cost of the antique clock is:

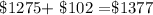

Therefore, her total cost for the antique is the addition of the cost of the antique and the sales tax

Her total cost for the antique clock is $1377