Check each option to see if it satisfies both conditions:

1.- x≤180

2.- x+y≤400

Remember that x represents regular cars and y represents compact cars.

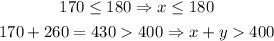

170 regular, 260 compact.

Then, x=170 and y=260

The second condition is not satisfied.

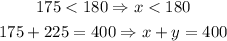

175 regular, 225 compact

Then, x=175, y=225

Both conditions are satisfied, then this option is correct.

210 regular, 190 compact

Then, x=210, y=190

![undefined]()