SOLUTION

The formula for simple interest is

From the given information

P=$8000

R=4

T=6

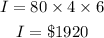

Substituting these values gives

Simplify the equation

Therefore, the total Interest Karen will have to pay is $1920

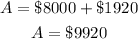

The total amount Karen will pay is

The total repayment will be $9920