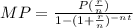

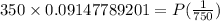

The rule of the monthly payment is

P is the initial amount of the loan

r is the rate in decimal

n is the period per time

t is the time

Let us find the value of them

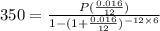

r = 1.6% = 1.6/100 = 0.016

The interest is compounded monthly, then

n = 12

It is for 6 years, then

t = 6

The monthly payment is $350, Then

M.P = 350

let us substitute these values in the rule above to find P

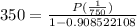

We will simplify it

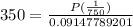

By using cross multiplication

Multiply both sides by 750 to find P

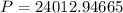

a) The Expensive of the care is $24012.94665

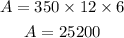

The total interest will be the difference between the total monthly payment and the purchase price

The total payment will be the monthly payment multiply by the number of months

The Interset = 25200 - 24012.95 = 1187.05

b) The total interest is $1187.05