ANSWER :

$40,000 for 6% and $130,000 for 12%

EXPLANATION :

The formula for interest is :

Where I is the interest

r is the rate of interest

t is the time in years

Their total investment is $170,000, and they want to divide it into two parts, let's say P1 and P2.

P1 + P2 = 170,000

One investment has 6% interest, and the other has 12%.

So we have r1 = 6% or 0.06

and r2 = 12% or 0.12

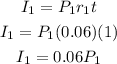

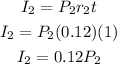

Solve for the interest in t = 1 year

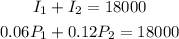

They want to have an interest of $18,000 per year.

So I1 + I2 = 18,000

This will be :

From the first equation we have :

P1 + P2 = 170,000

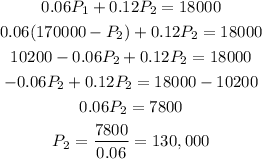

Express P1 in terms of P2 :

P1 = 170,000 - P2

Substitute this P1 to the equation above.

Now we have P2, solve for P1

Therefore, the investment will be $40,000 and $130,000