We have to calculate the future value of making monthly deposits of $2000 in a bank that gives 4% interest compounded quarterly.

As the frequencies between the deposits and the compounding are different, we have to calculate a equivalent rate that compounds at the same frequency as the deposits (monthly) that keeps the same effective interest rate.

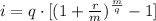

We have a nominal annual rate of 4% that compounds quarterly (m = 3). We can calculate the equivalent nominal annual rate as:

where m = 3 is the current compounding subperiod, q = 12 is the new compounding subperiod and r = 0.04 is the current annual rate.

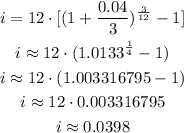

We replace the values and calculate:

We can now use the interest rate i = 0.0398 compounded monthly as the equivalent rate.

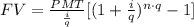

We can calculate the future value of the annuity as:

Where PMT = 2000, i = 0.0398, q = 12 and n = 4.

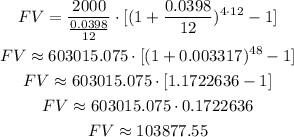

We can replace with the values and calculate:

We get a future value of the annuity of $103,877.55.

We have some differences corresponding to the roundings made in the calculation, but this value correspond to the option $103,891.58.

Answer: $103,891.58