Given:

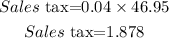

The total cost of espresso machine costs $46.95. and the tax rate is 4%.

To find:

Find the sales tax?

Step-by-step explanation:

Solution:

We will start by converting sales tax percentage into a decimal by moving

the point two spaces to the left.

6%=0.06

Now, we need to multiply the pre-max cost of this item by this value

in order to calculate the sales tax cost

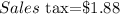

Round to two decimal places

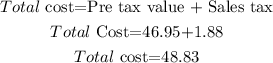

Last, add this value of the pre-tax value of the item to find the total cost.

Hence, these are the required values.