Problem

You have $20,000 that you want to deposit into a savings account.

You have four options to choose from, Bank A offers 4.25% compounded monthly, (Ex 2) Bank B offers 6% compounded Semi Annually, (Ex 2) Bank C offers a simple interest account with a 5.5% rate, (Chapter 8.3) Bank D offers a rate of 4% compounded continuously. (Ex 3) How much money will you have in each account if you let the money sit for 5 years? Which is the best choice?

Solution

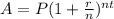

For this case we need to take in count the compound interest formula given by:

Where P= 20000, r= interest rate in fraction and n= number of times that the rate is compounded in a year, t= 5 years and A is the future value

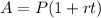

And the simple interest formula:

And compound continuosly:

Let's calculate the final amount for each case

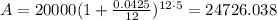

Bank A

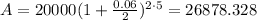

Bank B

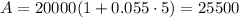

Bank C

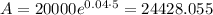

Bank D

And the best choice for this case seems to be Bank B since we will have more money at the end of the 5 year