Step-by-step explanation

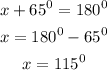

From the image, angle x and 65 degrees form angles on a straight line. We will recall that the sum of angles on a straight line sums up to 180 degrees.

Therefore,

Angle y and 65 degrees form alternate angles, we will recall that alternate angles are equal

Therefore,

Angle x and angle z form corresponding angles, we will recall that corresponding angles are equal.

Therefore,

Answer: