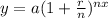

The compound interest model is given by the following expression:

Where a is the principal (initial amount), r is the interest rate in decimal form, n is the number of times compounded in a year and x is the number of years.

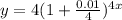

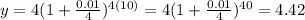

a) In this case, $4 are invested at 1% interest rate, then a = 4, r = 0.01 (1%) and n = 4 (compounded quarterly) and the above equation can be rewritten to get a model that led us to calculate the value of your shares over the time like this:

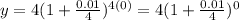

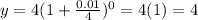

b) By replacing 0 for x, we can determine the y-intercept of the model, like this:

The result of raising any number to 0 is 1, then we get:

Then, the y-intercept if this model is 4 and it represents the initial amount invested ($4)

c) By replacing 10 for x, we get:

Then, after 10 years the estimated value of the shares will be $4.42

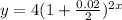

d) for a $4 stock with 2% interest compounded semiannually the model changes, we can write it like this:

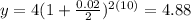

By replacing 10 for x, we get:

As you can see, after 10 years the estimated value of the shares will be $4.88, which is greater than the previous penny stock investment, you would have shared better.