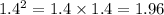

For the first expression, we have 1.4², this can be expressed as 1.4×1.4 and then we get:

For the second expression, 300 ÷ 2(0.5 + 4.5)² we must start by solving the sum inside the parenthesis, then we get:

300 ÷ 2(0.5 + 4.5)² = 300 ÷ 2(5)²

Then, solve the exponent on the right of the division symbol:

300 ÷ 2(5)² = 300 ÷ 2×25

Now, solve the multiplication

300 ÷ 2×25 = 300 ÷ 50

Now, we can solve the division

300 ÷ 50 = 6

Then, 300 ÷ 2(0.5 + 4.5)² = 6

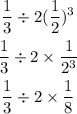

For the last expression, we must start with the exponent:

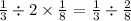

Now we can solve the multiplication:

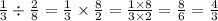

In order to divide one fraction by another one we just have to keep the first fraction unchanged, change the ÷ for a × and flip the second fraction, like this:

Then, the value of the last expression is 4/3