ANSWER

The volume of the container that the gas is in is 57.9L

Step-by-step explanation

Given that

The moles of the gas is 17.3 moles

The pressure of the gas is 7.5 atm

The temperature of the gas is 306K

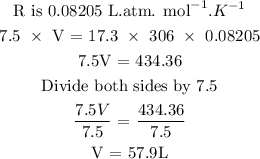

Follow the steps below to find the volume of the container

Step 1; Assume the gas behaves like an ideal gas

Therefore, the volume of the container that the gas is in is 57.9L