The rule of the payout annuity is

P is the initial amount

d is regular withdrawals

r is the annual rate in decimal

n is the number of periods in a year

t is the time

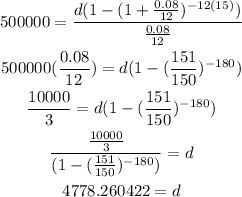

Since you have $500 000 saved, then

P = 500000

Since the interest is 8%, then

r = 8/100 = 0.08

Since the time is 15 years, then

t = 15

Since you want the monthly amount, then

n = 12

Substitute them in the rule to find d

Then you will be able to pull $4778.260422 each month