hello

to compare or know the difference between rational numbers and integers

rational numbers are numbers in which are expressed as fractions of two integers eg a/b where b is a non zero number

integers are whole numbers in mathemathics without the expression in fraction or rather they're expressed in fractions but the denominator must be equal to 1

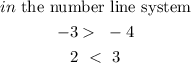

now when we want to compare and order integers, they're prefereably done using the number line system.

for an integer

while in rational numbers,