Let's begin by listing out the given information:

Home (Property Value) = $112,500

Assessment rate = 43% = 0.43

Property tax rate = $32.89 per $1,000 of assessed value

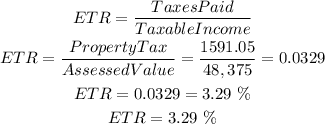

The Property tax is calculated using the formula:

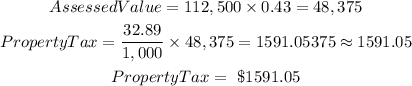

The effective tax is calculated using the formula: