Problem Statement

Kevin is trying to keep his heart rate at 160 beats/minute and in his workout, he counts 14 beats in 6 seconds. We are asked to find:

1. How many beats per minute is 14 beats in 6 seconds

2. Should he work out a little bit more?

Solution

- During Kevin's workout, we are told that he counts 14 beats in 6 seconds. We need to convert this to beats per minute so that we can compare it with 160 beats per minute.

- To convert 14 beats in 6 seconds to beats per minute, we would follow the pattern as follows:

Kevin counts 14 beats in the first 6 seconds

Kevin would count 2(14) = 28 beats in the first 6(2) = 12 seconds

Kevin would count 3(14) = 42 beats in the first 6(3) = 18 seconds

- We can generalize this pattern as follows:

Kevin would count n(14) = 14n beats in the first 6(n) = 6n seconds.

- This implies that if we want to know the number of beats his heart would go for every 1 minute, we simply need to find the number of beats for 60 seconds.

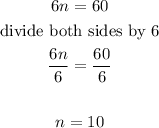

Thus, we can find the value of n by equating 6n seconds to 60 seconds.

- If n is 10, then we can use our general statement to find the number of beats Kevin's heartbeats per minute.

- Kevin would count 10(14)= 140 beats in the first 6(10) = 60 seconds= 1 minute.

Answer to Question 1

- Thus, Kevin's heat rate is 140 beats per minute

Answer to Question 2

-