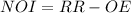

Net operating income (NOI) is a calculation used to analyze the profitability of income-generating real estate investments. NOI equals all revenue from the property, minus all reasonably necessary operating expenses.

The NOI is calculated as:

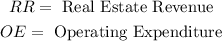

where:

Let us determine the revenue and expenditure.

Revenue:

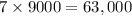

There are 7 office suites, each with a potential annual rent of $9,000 each. Therefore, the total potential income on rent is:

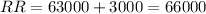

The revenue from the vending machine is $3,000.

Hence,

Expenditure:

The vacancy is 8% of the expected rent. This is calculated to be:

Annual expenses are $25,000.

Hence,

NOI:

Therefore, the NOI is calculated to be:

The NOI is $35,960.

The SECOND OPTION is correct.