We are given a a savings and loan investment that offers a monthly compounding rate with an annual percentage yield (APY) of 5.25%.

We are now required to use this information to calculate the nominal rate of interest compounded monthly.

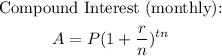

The compound interest formula for monthly compounding is given as;

Where the variables are;

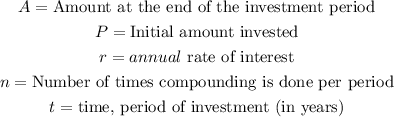

However, where we have the annual percentage yield already given, we can use that information to calculate the annual rate of interest as given by the formula below;

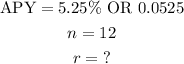

The variables given are;

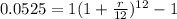

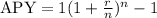

Substituting these into the formula we now have;