The Solution:

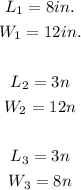

Given:

We are required to find the amount it will cost to make 600 of the above boxes if cardboard cost $0.05 per square inch.

Step 1:

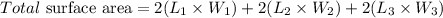

Find the surface area of the box.

In this case,

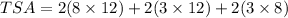

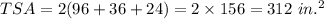

Substituting these values in the formula, we get:

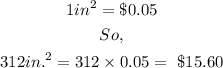

Step 2:

Find the cost of one box.

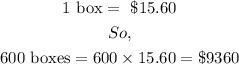

Step 3:

Find the cost of 600 boxes.

Therefore, the correct answer is $9360.